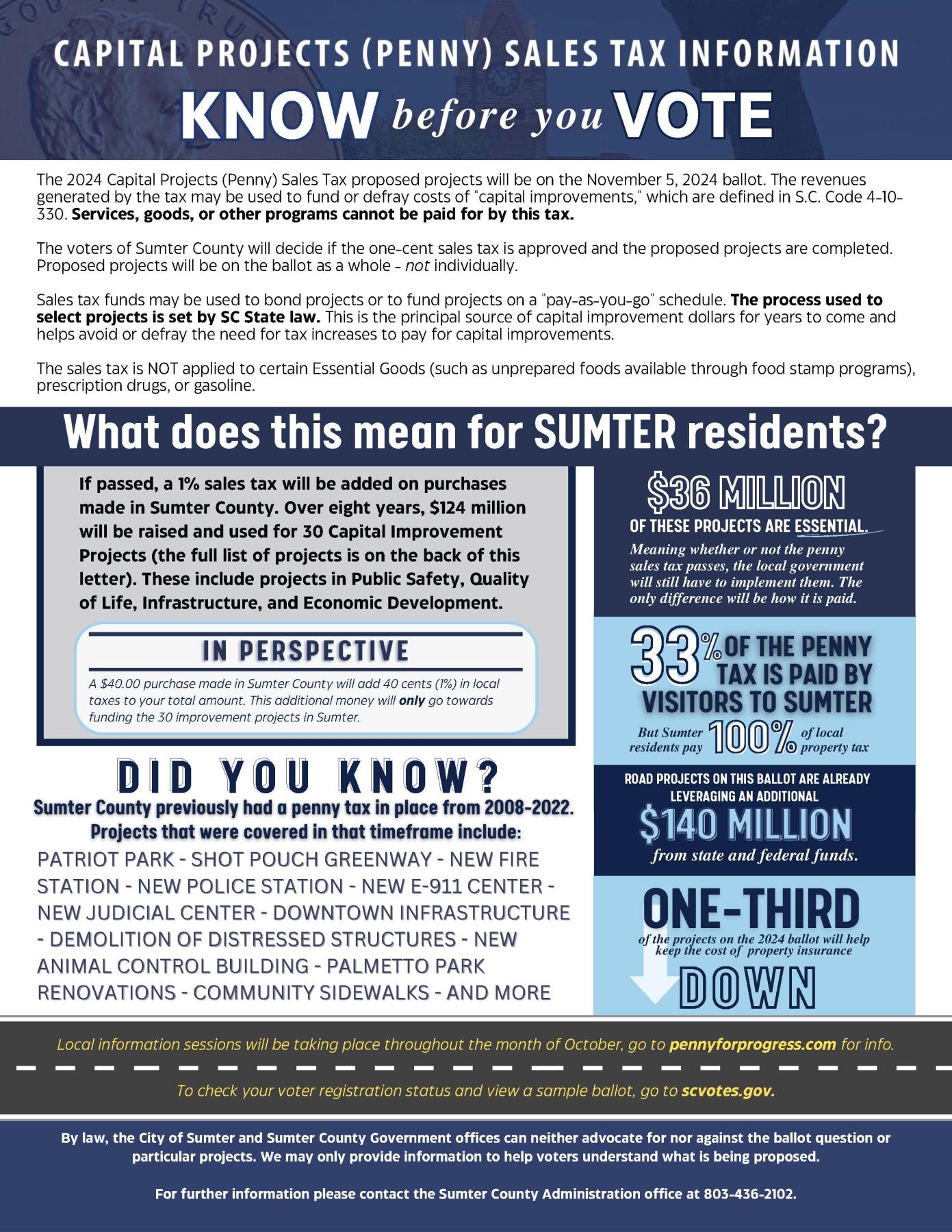

This post contains general information regarding the 2024 Capital Projects (commonly called "Penny" or "Penny for Progress") Sales Tax proposed projects that will be on the November 5, 2024 ballot. The revenues generated by the tax may be used to fund or defray costs of "capital improvements," which are defined in S.C. Code 4-10-330.

What does "Capital Projects" mean? A capital improvement is adding a permanent structural change or restoring some aspect of a property that will either enhance the property's overall value, prolong its useful life, or adapt it to new uses. By law, services, goods, or other programs cannot be paid for by this tax.

SC Code Section 4-10-330. The purpose for which the proceeds of the tax are to be used:

(a) highways, roads, streets, bridges, and public parking garages and related facilities;

(b) courthouses, administration buildings, civic centers, hospitals, emergency medical facilities, police stations, fire stations, jails, correctional facilities, detention facilities, libraries, coliseums, educational facilities under the direction of an area commission for technical education, or any combination of these projects;

(c) cultural, recreational, or historic facilities, or any combination of these facilities;

(d) water, sewer, or water and sewer projects;

(e) flood control projects and stormwater management facilities;

(f) beach access and beach renourishment;

(g) dredging, dewatering, and constructing spoil sites; disposing of spoil materials and other matters directly related to the act of dredging;

(h) jointly operated projects of the county, a municipality, special purpose district, and school district, or any combination of those entities, for the projects delineated in subitems (a) through (g) of this item;

(i) any combination of the projects described in subitems (a) through (h) of this item;

The voters of Sumter County will decide if the one-cent sales tax is approved and the proposed projects are completed. Proposed projects will be on the ballot as a whole - not individually - meaning all projects move forward with a "yes" vote or none with a "no" vote.

Sales tax funds may be used to bond projects or to fund projects on a "pay-as-you-go" schedule. The process used to select projects is set by SC State law. This is the principal source of capital improvement dollars for years to come and helps avoid or defray the need for property tax increases to pay for capital improvements.

The sales tax is not applied to certain Essential Goods (such as unprepared foods available through food stamp programs), prescription drugs, or gasoline. For more on what is exempt, click here.

By law, the City of Sumter and Sumter County Government offices can neither advocate for nor against the ballot question or particular projects. We may only provide information to help voters understand what is being proposed.

Local information sessions will be taking place throughout the month of October, go to pennyforprogress.com for info.

For further information, please contact the Sumter County Administration office at 803-436-2102.

Helpful Links:

- Click here to view a sample Sumter County ballot (PDF).

- Click here to check your voter registration status and view your sample ballot.

![]() Check Your Registration: Ensure your voter registration is up-to-date.

Check Your Registration: Ensure your voter registration is up-to-date.![]() Learn About the Candidates and Issues: Research what's on your ballot.

Learn About the Candidates and Issues: Research what's on your ballot.![]() Plan Your Vote: Decide whether you'll vote early, absentee, or on Election Day.

Plan Your Vote: Decide whether you'll vote early, absentee, or on Election Day.![]() Know Your Polling Location: Verify your polling place and its accessibility.

Know Your Polling Location: Verify your polling place and its accessibility.

Sample Ballot

Capital Projects (Penny) Sales Tax Referendum will be located under "Local Questions"

Must a special One Percent Sales And Use Tax be imposed in Sumter County (the “County”) for not more than eight (8) years, to begin May 1, 2025, to raise the amounts specified for the following purposes and in order to pay the costs (including rights-of-way acquisition and architectural, engineering, legal, administrative costs, and related fees) of the projects described below; pending the receipt of such sales and use tax, must the County also be authorized to issue and sell, either as a single issue or as several separate issues, General Obligation Bonds (the “Bonds”) of the County in the aggregate principal amount not to exceed $40,000,000.00 to be paid from the Sales And Use Tax to be received and to pledge The Sales And Use Tax to be received to the payment of the principal of and interest on the Bonds?

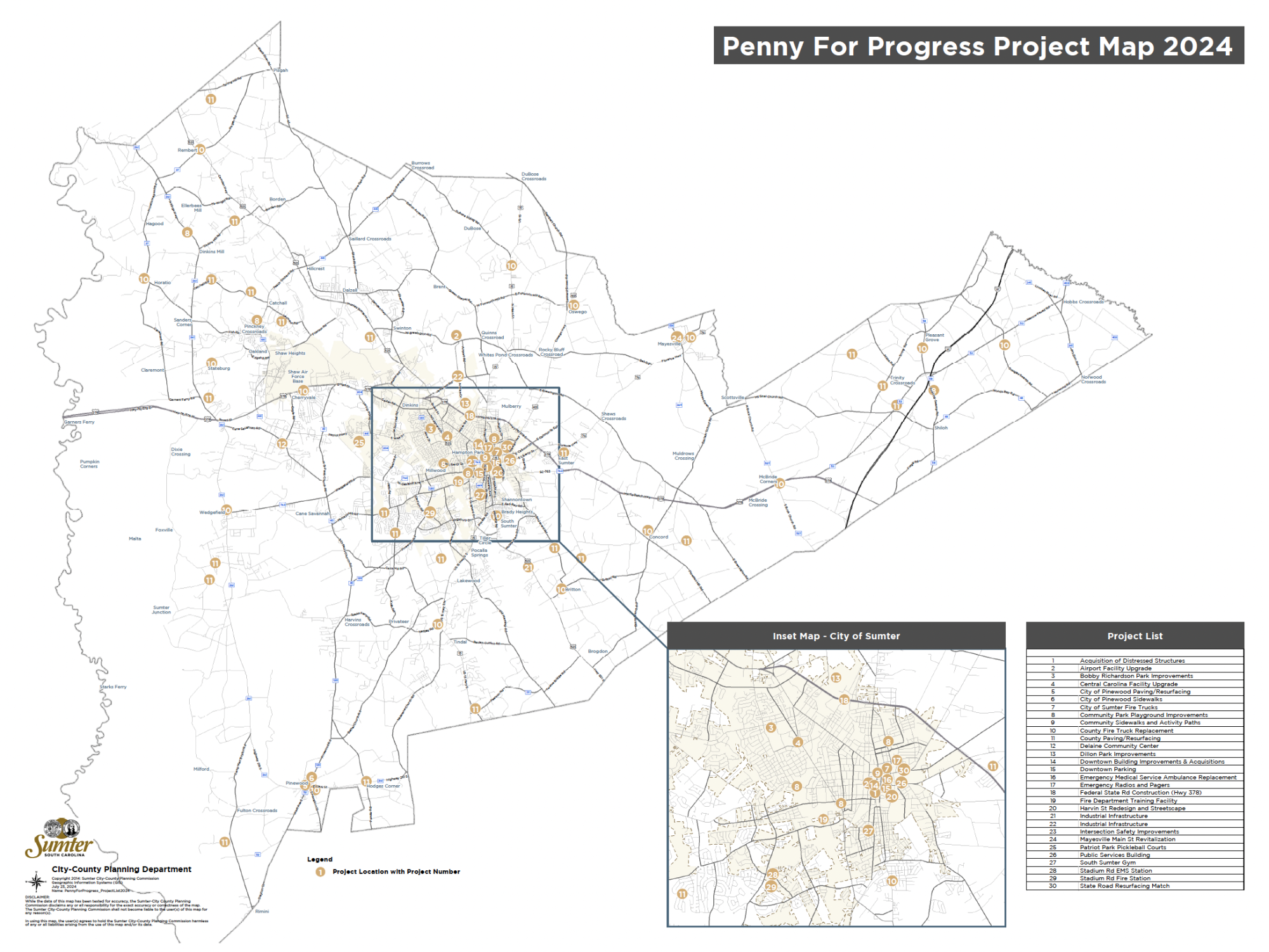

- $13,000,000–Emergency Radios / Pagers. New communications technology infrastructure to meet man-dated digital radio and pager services, allowing county-wide coverage, and will replace obsolete radios and pagers.

- $14,000,000 – County Fire Trucks. Replace dated fire trucks throughout the County. Rural fire stations are Cherryvale, Bethel, Graham, Pinewood, Pleasant Grove, Mayesville, Dabbs, Byrd’s, Wedgefield, Rembert, Beech Creek, Concord, Horatio, Dubose, Oswego, Dalzell, and Manning Road.

- $5,000,000 – City Fire Trucks. Purchase fire trucks to service City and local industries.

- $1,500,000 – Stadium Road EMS Station. A new 4,000 sq. ft. satellite facility to include a two-bay truck port. Located on Stadium Road on property behind the Fire Station.

- $1,000,000 – EMS Ambulances. To purchase four (4) new ambulances to replace the aged high mileage fleet for County-wide service area.

- $2,000,000 – Industrial Infrastructure. To construct a “Pad Ready” industrial site approximately 200,000 sq. ft. with options to expand for industrial recruitment.

- $1,750,000 – Intersection Safety Improvements. Improve safety for all pedestrians at crosswalks/ intersections near schools and neighborhoods.

- $2,500,000 – Bobby Richardson Park Improvements. To transform the park into a state-of-the-art Baseball Complex to include a practice facility, increased parking capacity, and two new entrances for better accessibility.

- $2,800,000 – Patriot Park Pickleball Courts. Expand Patriot Park to include fifteen (15) new Pickle Ball Courts along with adjacent parking to support this and other park activities.

- $2,750,000 – Downtown Building Improvements & Acquisitions. Downtown building renovations and purchases to drive economic development initiatives including utility upgrades at the Liberty Center.

- $21,000,000 – County Paving/Resurfacing. New paving road projects on 18.34 miles of dirt roads to ease public travel and emergency vehicle accessibility and to improve maintenance service on other County roads. PAVING ROADS to include: Ambrose Drive, Bainbridge Road, Bunneau Street, Campbell Court, Coastal Dr., Gaymon Road, Heirs Drive, Hugh Ryan Road, Jaguar Run, James Quincy Court, James Quincy Road, Joe Billy, Loblolly Road, Lynx Lane, Mayrant Court, McLean Street, Millhouse Road, Mundy Street, Munn Street, N. Mayrant Cir., Northridge Drive, Old Stone Road, Ott Street, Pasture Road, Pratt Avenue, Rosehill Road, Rufus Drive, Scotts Branch, S. Mayrant Cir., Sparkleberry Rd,, Statesburg Hills, Stukes Road, Tate Street, Teakwood Drive, Walters Avenue, and Woods Street. Resurfacing road projects for 7.07 miles. RESURFACING ROADS to include: Meadowcroft Dr., Ashlynn Way, Caitlynn Dr., Tamarah Way, Kari Drive, Candlelite Court, Fallingwater Lane, Sun Valley Dr., Christopher Ct., Malone Drive, Inabinet Drive, Wind Tree Dr., Steeplechase Drive, Soye Dr., Longbranch Drive, Soye Circle, Bend K Drive, Colts Run Ct., and Cliffwood Court.

- $3,000,000 – Stadium Road Fire Station. Rebuild the Stadium Road Fire Station.

- $1,000,000 – Fire Depart. Training Facility. To purchase and install a “Live Fire” training facility to accomplish general firefighter training.

- $6,000,000 – Federal State Road Construction (Hwy 378). Reconnect the communities and services north and south of the US-378 Bypass at Wesmark and Miller Roads to improve safety for drivers and pedestrians and enhance mobility for all travelers. Funds will be used to leverage State and Federal Transportation project.

- $10,000,000 – State Road Resurfacing Match. This project will be used to draw down additional funds from the State Department of Transportation to prioritize and expedite critical state road projects in Sumter County.

- $3,250,000 – Public Services Building. Renovate and expand Public Services Complex including infra-structure needed to aid in disaster response activities.

- $1,500,000 – Industrial Property Acquisition. Purchase additional property for industrial growth and economic development.

- $2,600,000 – Dillon Park Improvements. New restroom facilities to support athletic events including a restroom to support the 1-mile walking track. Replace six (6) outdated ballfields’ lighting systems with a brighter, more energy efficient LED system. Renovate Crystal Lakes Golf Course Driving Range to support youth and senior golf participants.

- $4,000,000– Community Park Playground Improvements. Enhance public parks with infrastructure that adds safety and security, as well as modern playground equipment accessible for all children to include Swan Lake, Birnie Center, Crosswell, Catchall-Shaw, Shiloh, Rafting Creek, and others.

- $1,000,000 – Central Carolina Facility Upgrade. Renovation of the Health Center building into classroom space for additional Health Sciences programs. Create walkways to connect the Health Center, Health Science building, and the Annex.

- $1,500,000 – Mayesville Main Street Revitalization. The commercial mixed-use development will revitalize the economy in Mayesville, create a gathering place with covered seating, eating areas, co-op grocery store, and an upscale farmers market.

- $1,200,000 – Pinewood Road Paving. New road paving on 1.11 miles of dirt roads to ease public travel and emergency vehicle accessibility and to improve maintenance service on other Sumter County roads. Roads to be paved in the downtown area: Railroad Ave., Nelson Street, and McBride Street.

- $9,500,000 – Dugan St. and Downtown Parking Facility. Connect parking and access from Dugan to Bartlette (parallel to South Main Street). Also provide additional parking infrastructure (parking deck) to support downtown development including a downtown hotel and convention facility.

- $1,250,000 – Delaine Community Center. Construct a new community center for seniors and youth with approximately 4,000 sq. ft. to replace the current center located near the old Delaine School.

- $3,000,000 – South Sumter Gym. Reconstruction/expansion of the South Sumter Gym.

- $1,500,000 – Harvin Street Redesign and Streetscape. Improve downtown safety and increase on-street parking capacity.

- $300,000 – Pinewood Sidewalks. Expands the community sidewalk network, providing safe walking connections to neighborhoods, schools, parks, and commercial areas.

- $3,500,000 –Community Sidewalks / Activity Paths. Expand Sumter’s sidewalks and activity path networks to allow easier access to work- places, goods, services, and recreation to include Wise Dr., Rast St., Winn St., Mason Rd., South Harvin St., E. Charlotte Ave., Calhoun Dr., Boulevard Rd., S. Sumter St., Miller Rd., Hoyt St., Stadium Rd., N. Lafayette Dr., Fulton St., and connection between Shot Pouch Greenway and Palmetto Park.

- $1,000,000 – Airport Facility Upgrade. Expand portion of terminal, upgrade flooring and other cosmetic improvements. Extend the taxiway on the southwest portion of the tarmac to allow construction of up to four (4) new airplane hangars.

- $2,500,000 Community-wide Acquisition of Distressed Structures. To improve the community by acquiring and removing distressed structures that degrade neighborhoods and major corridors.

[TOTAL COST OF ALL CAPITAL PROJECTS: $124,900,000.00.]

The maximum amount of net proceeds of the Sales And Use Tax which may be applied to the payment of the principal of and interest on the County’s General Obligation Bonds (the “Bonds”)must not exceed $46,000,000.00 (based upon expected Sales And Use Tax collections of$124,900,000.00 less administrative expenses of collection). The not-to-exceed $40,000,000.00principal amount of Bonds to be issued shall be repaid from the net proceeds of the Sales And Use Tax which shall be pledged for the repayment of the Bonds.

[ ] YES, In Favor Of The Question

[ ] NO, Opposed To The Question